If you’ve been using QuickBooks, you already know it’s one of the most recognized accounting and financial management platforms out there. But as businesses grow or shift to more modern, hybrid, and remote work models, many users are finding that QuickBooks isn’t quite keeping up, especially when it comes to real-time productivity tracking, employee accountability, or scalable pricing.

From limited integrations to high costs for advanced features, teams are on the hunt for more affordable, automated, and productivity-driven tools that go beyond just accounting.

In this guide, we’ll walk you through the top 5 alternatives to QuickBooks in 2026, and why Flowace is the #1 choice for teams looking to combine productivity, time tracking, and performance insights in one powerful platform.

Key takeaways:

1. QuickBooks excels at accounting—but not at productivity tracking.

It handles finances well but lacks the real-time insights, automation, and behavioral analytics modern teams need to operate efficiently.

2. Flowace fills the operational visibility gap QuickBooks leaves.

With AI-driven productivity insights, automated time tracking, and team performance dashboards, Flowace is built for how today’s teams work.

3. The best QuickBooks alternative depends on your business model.

Flowace is ideal for productivity-first teams, Zoho Books is perfect for Indian SMBs, FreshBooks shines for freelancers, Xero serves global businesses, and TallyPrime is suited for traditional Indian SMEs.

4. The evaluation framework looked at 9 criteria to ensure objectivity.

This includes accounting strength, automation, scalability, ecosystem compatibility, pricing, security, and real user reviews.

5. Businesses are moving toward tools that merge finance with productivity insights.

The future of business operations is not just knowing the numbers—it’s understanding the work behind the numbers. Flowace stands out because it unifies both.

What is QuickBooks?

QuickBooks is one of the most popular accounting and financial management software platforms designed primarily for small and medium-sized businesses. Built by Intuit, it helps companies track their finances, manage invoices, handle payroll, organize expenses, and generate reports, all in one centralized system.

At its core, QuickBooks simplifies bookkeeping so business owners, accountants, and finance teams can spend less time on manual calculations and more time running the business. It supports everything from daily expense tracking to advanced financial reporting, making it versatile enough for freelancers, startups, and multi-location companies.

QuickBooks also integrates seamlessly with banks, payment gateways, e-commerce platforms, and dozens of business tools, ensuring that financial data stays accurate and up to date.

Whether you’re trying to track cash flow, reconcile transactions, manage tax preparation, or automate billing, QuickBooks offers a streamlined, user-friendly solution that minimizes errors and increases financial clarity.

Pros

- User-friendly interface that makes accounting accessible even for non-accountants.

- Powerful automation for invoicing, payments, recurring billing, and expense tracking.

- Wide range of features including payroll, inventory tracking, budgeting, and tax management.

- Strong reporting capabilities with customizable financial reports.

- Cloud access (in QuickBooks Online) allowing teams to work from anywhere.

- Large integration ecosystem with CRM tools, payment processors, e-commerce platforms, and productivity apps.

- Scales easily from freelancers and small businesses to mid-sized companies.

- Built-in tax prep support to simplify filing and compliance.

- Bank reconciliation tools that automatically import and categorize transactions.

Cons

- It can get expensive, especially as you scale to higher-tier plans or add payroll services.

- Learning curve for advanced features, which may require training or accountant support.

- Occasional syncing issues with banks or integrations.

- Limited customization in lower-tier plans.

- Inventory management features aren’t robust enough for large or complex product-based businesses.

- Customer support can be slow, depending on the plan and region.

- Add-ons increase total cost, including payroll, advanced reporting, and third-party integrations

Why look for a QuickBooks alternative?

QuickBooks is widely known for robust accounting and financial tools. Yet, as businesses evolve—especially with the rise of remote and hybrid work—QuickBooks may not meet the emerging needs around productivity, real-time tracking, or team performance.

1. Limited insights into real-time productivity

QuickBooks primarily handles timesheet entry and billing data. It lacks live dashboards or behavioral analytics to help managers understand how time is actually being used, such as distinguishing deep work from distraction or tracking active vs idle time.

2. Manual or clunky time tracking

Time tracking in QuickBooks often relies on manual entry or separate add-ons. This introduces friction and errors. A modern alternative would automate time tracking in the background, capturing activity seamlessly without disrupting workflows.

3. Absence of adaptive, intelligent reporting

While QuickBooks excels at financial summaries and accounting statements, it doesn’t deliver insights into team performance trends or behavior patterns. Having automated productivity reports and visual analytics helps make smarter decisions and supports productivity improvement.

4. Basic team performance visibility

QuickBooks doesn’t offer tools for monitoring which parts of workflows are efficient versus inefficient, or for identifying high-performers and bottlenecks. Advanced productivity tools fill that gap with dashboards, alerts, and goal-tracking features.

5. Cost structure may not scale with productivity needs

QuickBooks pricing aligns with accounting functionality.

As businesses seek upgrades in productivity tracking, you may face additional costs and add-ons without a unified view of operational efficiency. An alternative built around both finance and productivity can offer better value and clarity at scale.

What to Look For in a QuickBooks Alternative?

When exploring replacements for QuickBooks, here are the key factors to keep in mind:

✅ Time & Task Tracking

✅ Real-Time Insights on Productivity

✅ Seamless Integrations with Accounting/HR Tools

✅ Automation & Custom Reporting

✅ Flexible Pricing Plans

✅ Scalability for Teams of All Sizes

When Would QuickBooks Be a Good Fit For You?

- You want an all-in-one financial management tool for invoicing, expenses, payroll, and reporting.

- You run a small or medium-sized business and need reliable bookkeeping without hiring a full-time accountant.

- You need to track income and expenses automatically by syncing with your bank and categorizing transactions.

- You send frequent invoices or recurring bills and want automated reminders and payment tracking.

- You want tax-ready financial reports like profit-and-loss statements and balance sheets for easier filing.

- You collaborate with accountants or bookkeepers and need secure, real-time access to your financial data.

- You expect your business to grow and scale, and want software that can handle inventory, payroll, or multi-currency support later.

- You prefer automation over manual data entry, saving time on recurring financial tasks.

How Did We Choose and Evaluate a QuickBooks Alternative?

To help you find the right fit, we applied a detailed and objective evaluation framework designed to identify the best QuickBooks alternatives for 2025 and beyond.

Here’s how we selected and evaluated each tool on this list:

1. Core Accounting and Financial Features

We began by assessing the fundamental accounting capabilities of each platform — including general ledger management, invoicing, expense tracking, payroll processing, and financial reporting.

Only tools offering strong foundations in double-entry accounting, tax compliance, and automation made the shortlist.

2. Usability and Learning Curve

While QuickBooks is powerful, many users find it overwhelming at first. So, we placed a strong emphasis on ease of setup, dashboard simplicity, and user experience.

Alternatives with clean interfaces, intuitive workflows, and guided onboarding earned higher scores for accessibility — especially for non-accountants or small business owners.

3. Scalability and Business Fit

We evaluated whether each software could grow with your business. This included looking at support for multiple entities, international currencies, large transaction volumes, and API integrations.

Scalable solutions that serve freelancers, SMBs, and enterprises alike — without forcing costly plan upgrades — were ranked higher.

4. Automation and Efficiency

Modern accounting is about reducing manual work. So, we prioritized tools that offer automation in reconciliation, invoice reminders, recurring billing, and tax calculations.

Platforms leveraging AI and machine learning to detect anomalies or predict cash flow trends scored especially high.

5. Pricing and Value for Money

QuickBooks pricing can add up quickly, especially with add-ons like payroll or advanced reporting. We compared total ownership cost, including hidden fees, transaction limits, and integration costs.

Solutions offering transparent pricing, flexible tiers, and strong features at lower costs ranked as better value alternatives.

6. Integrations and Ecosystem Compatibility

Accounting software doesn’t operate in isolation. We assessed how easily each tool connects with bank accounts, CRMs, project management tools, payment gateways, and tax filing systems.

Platforms with strong integration ecosystems — such as Xero, Zoho Books, or Flowace for time-based billing insights — stood out for enabling seamless business operations.

7. Security, Compliance, and Data Privacy

Financial data security is non-negotiable. We ensured every recommended tool follows industry-grade encryption, GDPR compliance, role-based access control, and secure backups.

Cloud-based solutions with transparent security practices and strong uptime reliability received higher trust ratings.

8. Customer Support and Community Trust

Accounting tools are only as good as the support behind them. We reviewed customer service responsiveness, available resources (like tutorials and webinars), and user community engagement.

Software with active help centers and dedicated account managers scored higher for dependability.

9. Reviews and Market Reputation

Finally, we cross-referenced user feedback from trusted review sites like G2, Capterra, and Trustpilot.

Tools with consistently high satisfaction scores, low churn rates, and strong adoption among SMBs or accountants were considered the most reliable QuickBooks alternatives.

Top 5 QuickBooks Alternatives in 2026

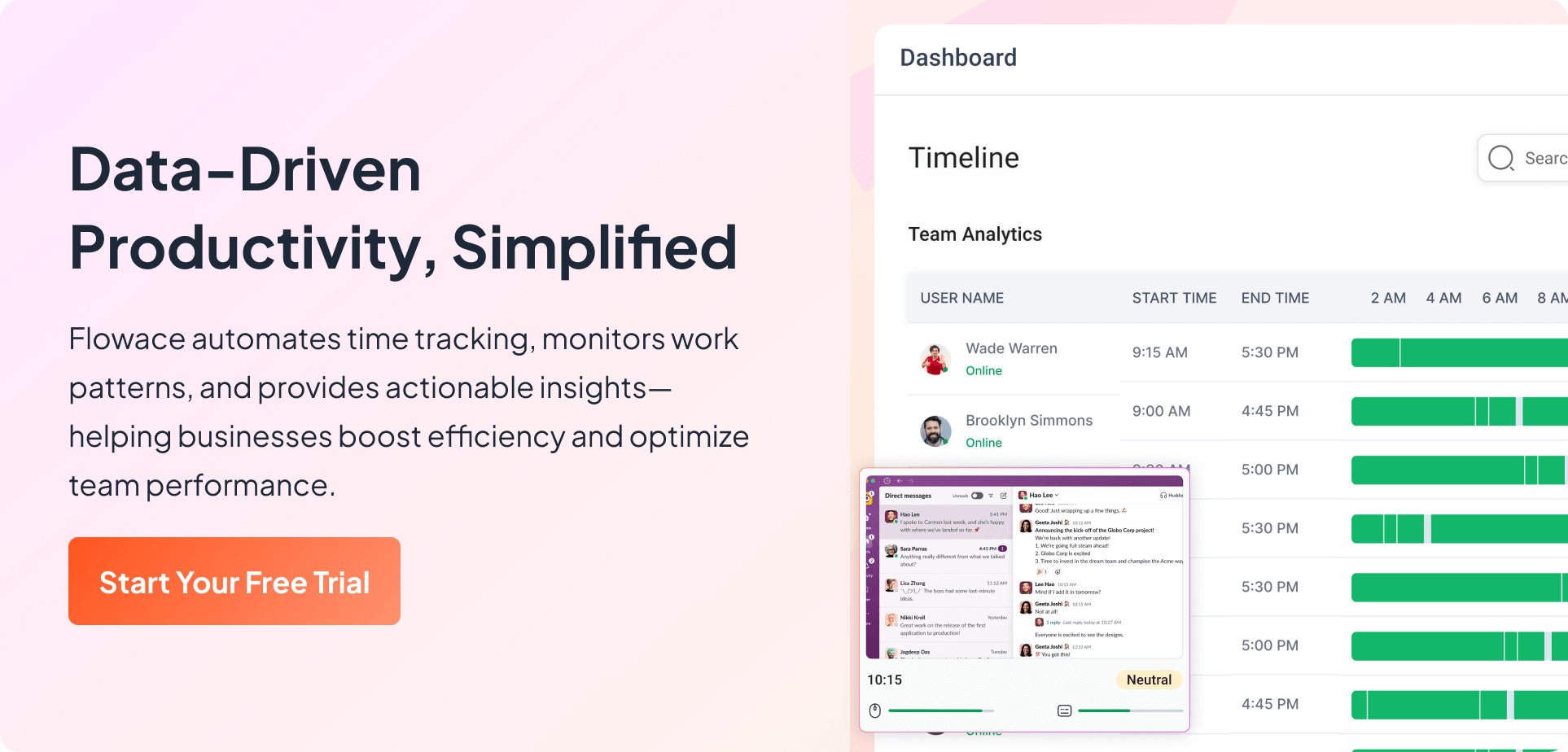

1. Flowace (Best Overall Alternative)

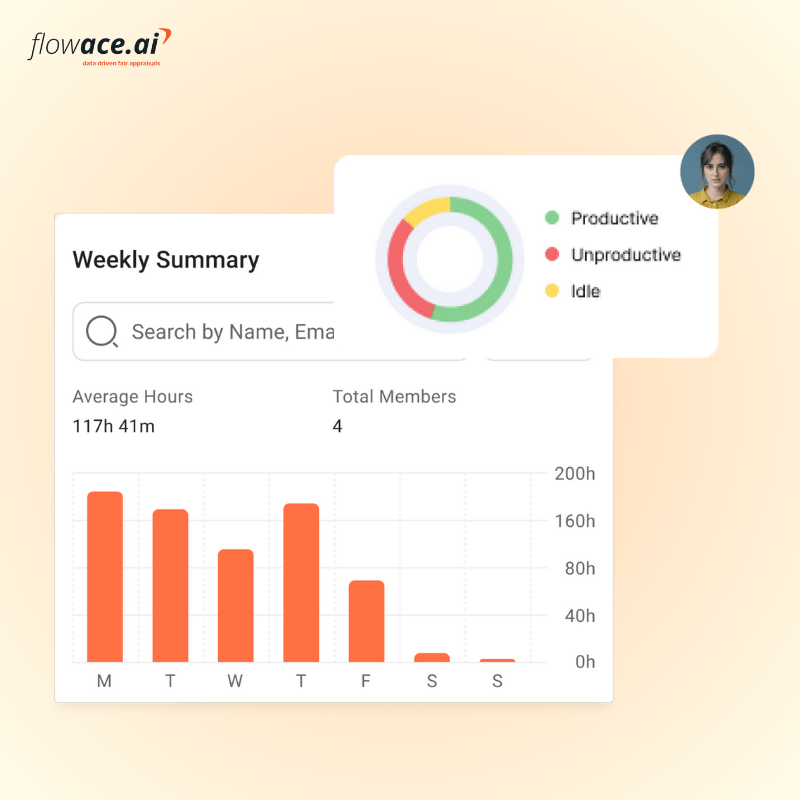

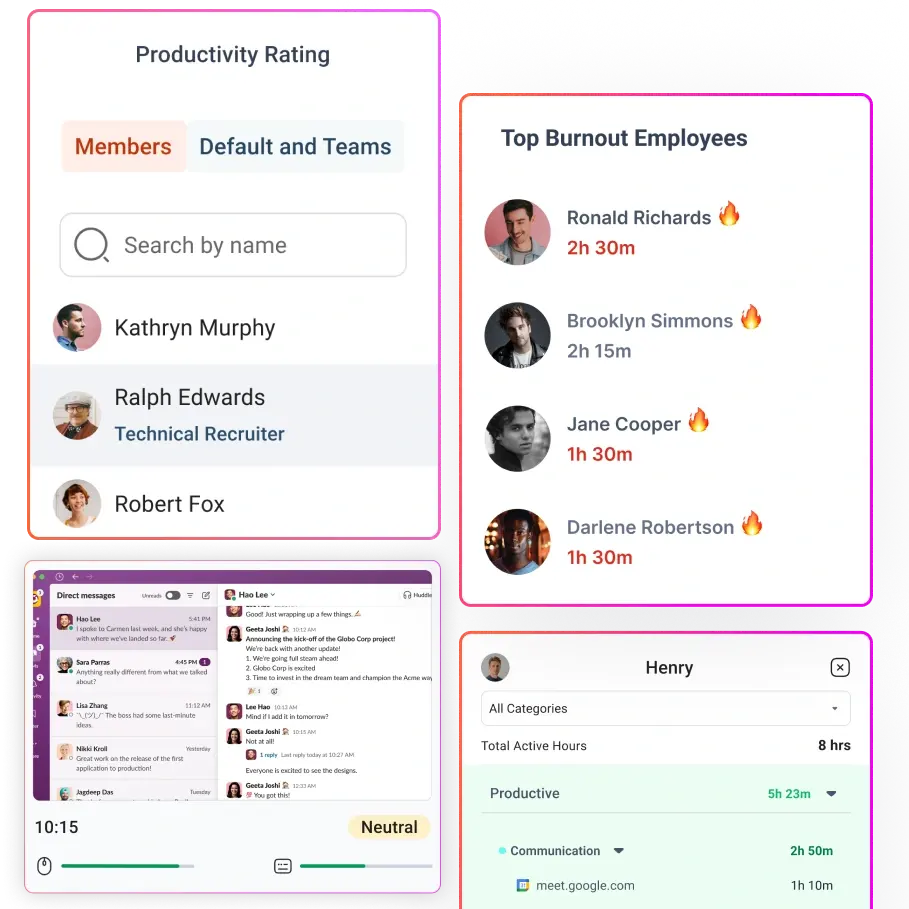

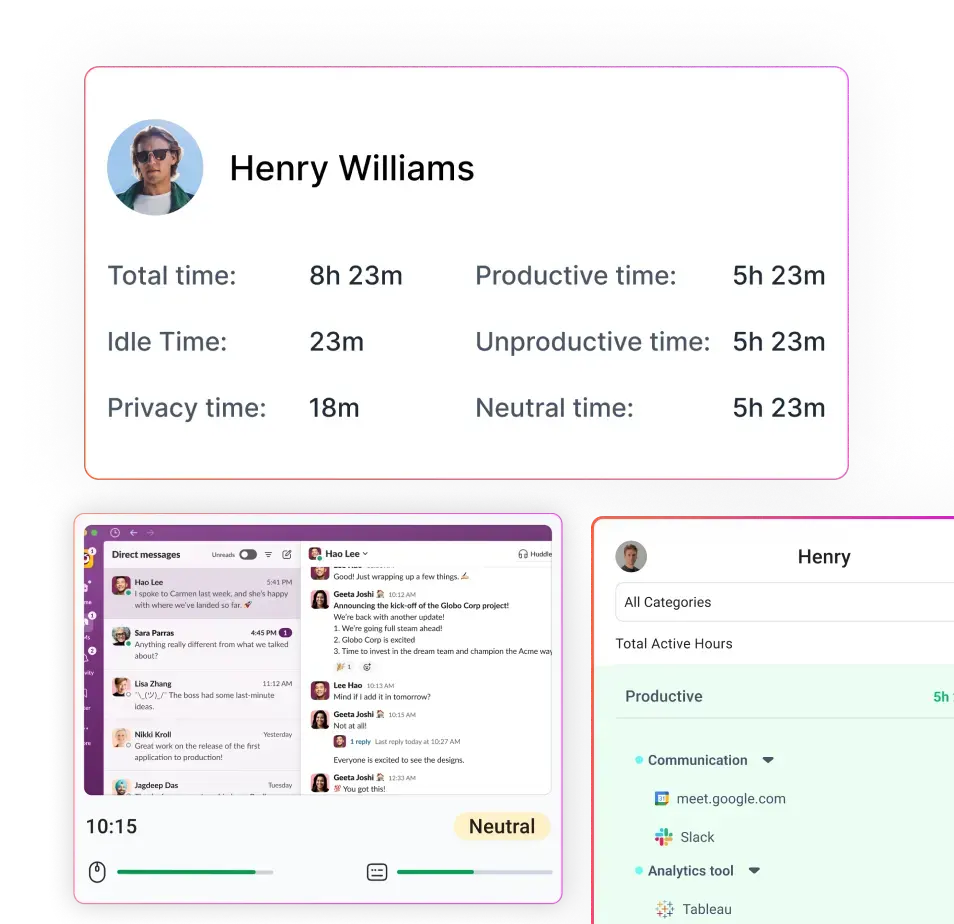

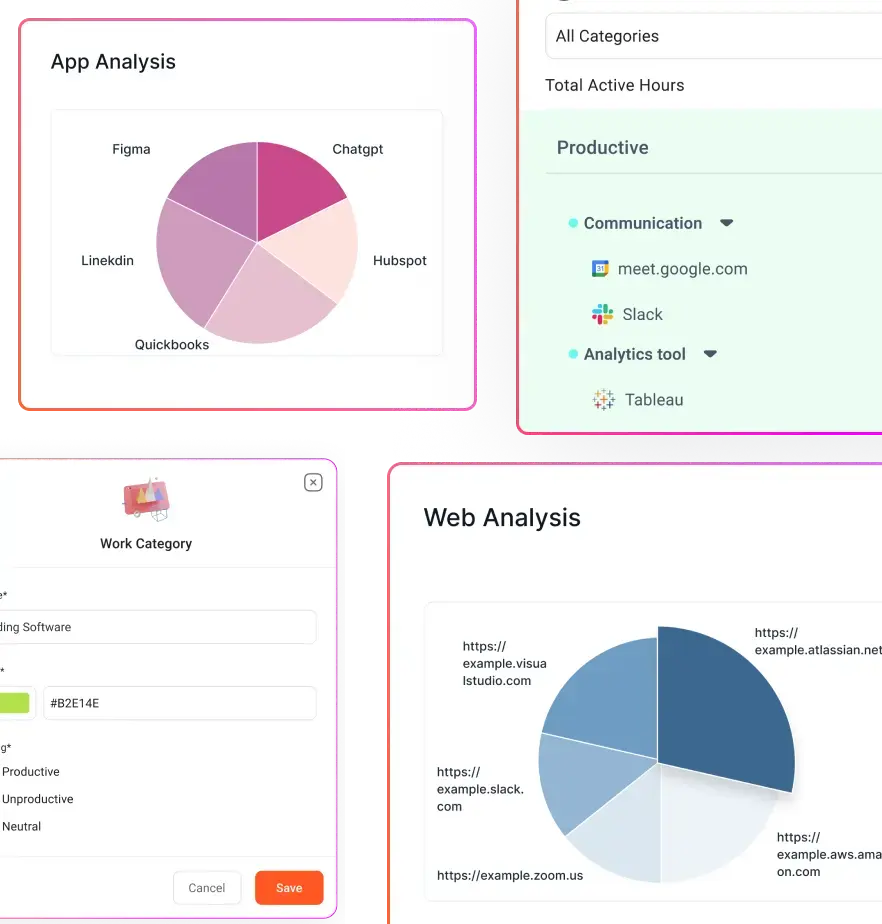

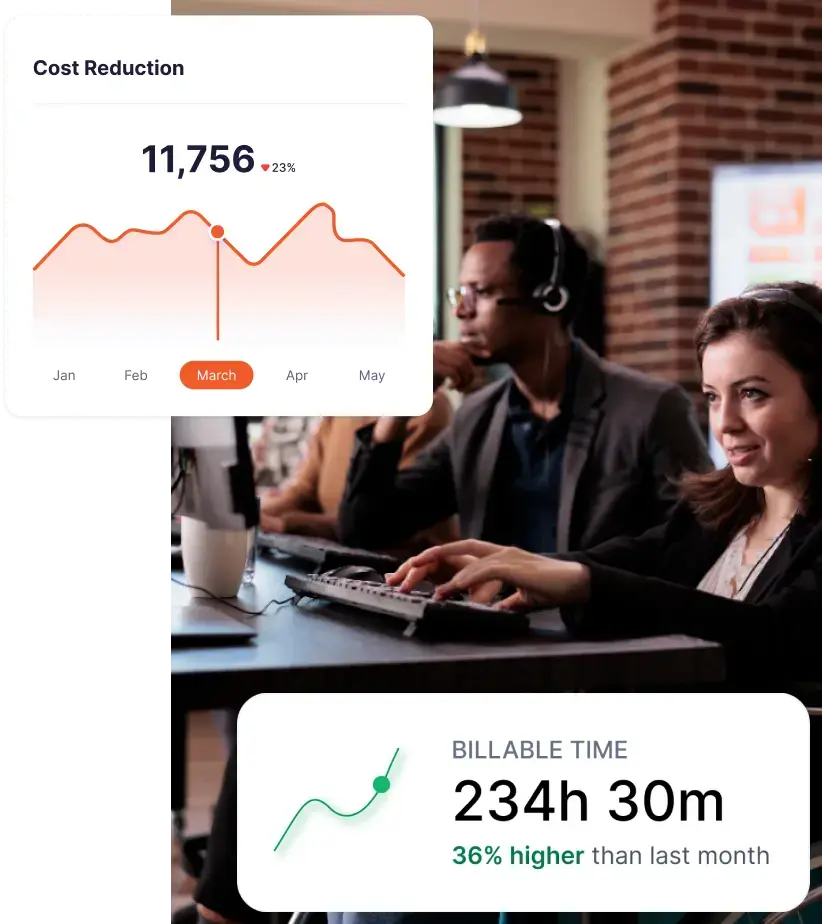

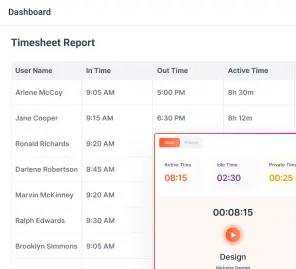

Flowace is an all-in-one employee productivity and time tracking platform designed for remote and hybrid teams. It combines AI-powered analytics, automated reports, and employee productivity dashboards to offer insights that help businesses run smarter.

Key features:

- Fully automatic “silent” time tracking with no manual timers.

- Screenshots at configurable intervals for context and transparency.

- App and website usage monitoring to understand digital habits.

- Idle-time detection with auto-discard options.

- Productivity ratings that classify tools and websites as productive, neutral, or distracting.

- Raw activity logs with highly detailed behavioral data.

- AI-powered alerts for anomalies, inactivity, or sudden productivity drops.

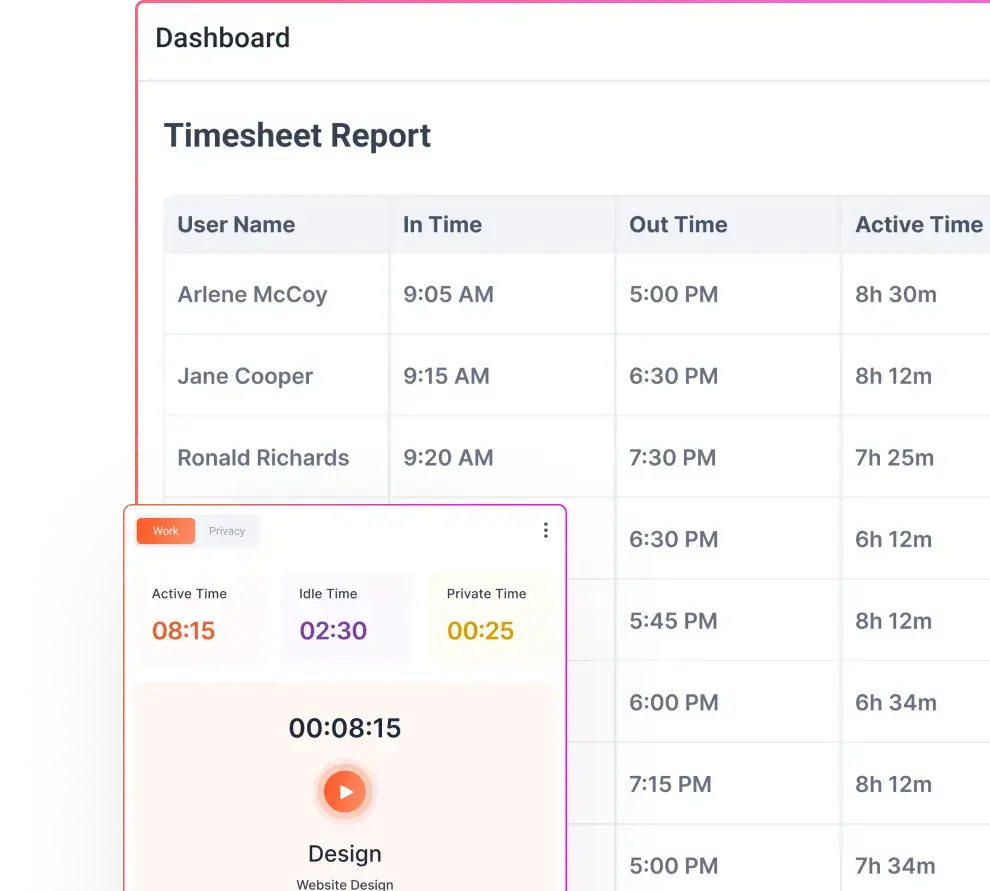

- Automatic attendance tracking and shift management.

- Built-in leave and holiday management workflows.

- Project and task tracking with accurate time allocation.

- Executive dashboards for high-level team utilization and productivity insights.

- Keyboard and mouse activity metrics (Premium plan).

- Internet connectivity and IP address tracking

Pricing:

Basic – $1.99/user/month

Core time tracking features like screenshots, attendance, dashboards, projects, tasks, and essential monitoring.

Standard – $3.99/user/month

Includes everything in Basic plus productivity ratings, break tracking, activity logs, AI alerts, shift scheduling, and integrations.

Premium – $6.99/user/month

Includes everything in Standard plus higher-frequency screenshots, keyboard/mouse activity tracking, client-access portals, executive dashboards, and extended data retention.

Enterprise – Custom pricing

Fully customizable monitoring rules, advanced analytics, premium support, and scalable deployment for large organizations.

User ratings:

Best For:

Flowace is a great alternative for Harvest if you manage remote teams or run multiple projects and want smarter, automated time tracking. Whether you’re a freelancer, an agency, or a growing business, it’s a solid upgrade.

2. Zoho Books

Zoho Books is a cloud-based accounting solution from Zoho’s vast suite of business apps. It caters to small and mid-sized businesses looking for a user-friendly financial tool that integrates easily with other Zoho products like Zoho CRM, Zoho Inventory, and Zoho Payroll.

Key Features:

- End-to-end accounting: invoicing, billing, and banking

- Project time tracking and expense logging

- GST-compliant filing and automated tax reports

- Integration with 50+ Zoho and third-party apps

- Customer and vendor portals

- Role-based access for team members

Why It’s Better Than QuickBooks:

- Affordable pricing, especially for Indian businesses

- Native GST and TDS compliance out of the box

- Better synergy with CRM and HR functions via the Zoho ecosystem

- Local customer support and regional customizations

User ratings: 4.4/5 – G2

“Zoho Books has been a game-changer for managing finances across multiple clients. The automation features, such as recurring invoices and payment reminders, save so much time, and the dashboard gives a clear overview of cash flow at a glance. I also find the seamless integration with other Zoho apps and third-party platforms like Stripe and G Suite useful.” – User on G2

Ideal For:

Startups and SMBs already using Zoho tools or looking for an all-in-one Indian ecosystem

3. FreshBooks

FreshBooks is a cloud-based accounting software designed with freelancers and service-based businesses in mind. It focuses on ease of use, project-based time tracking, and intuitive invoicing tools.

Key Features:

- Professional invoicing and recurring billing

- Time tracking by project or client

- Expense tracking and receipt capture

- Client communication and feedback tools

- Project collaboration with contractors

- Reports for taxes, profits, and revenue

Why It’s Better Than QuickBooks:

- More intuitive interface, especially for non-accountants

- Designed for client-based businesses like creatives, freelancers, and consultants

- Simple time and project tracking with team collaboration tools

User ratings: 4.5/4 – G2

“FreshBooks is extremely easy to use, even for someone without an accounting background. The interface is clean, intuitive, and saves me time when creating invoices, tracking expenses, or managing projects. Despite being user-friendly, it still offers a strong set of features like time tracking, recurring invoices, and payment reminders. It strikes the perfect balance between simplicity and functionality, which makes it a great tool for small businesses.” – User on G2

Ideal For:

Freelancers, consultants, creatives, and solopreneurs who need simplicity and speed

4. Xero

Xero is a premium cloud-based accounting software used worldwide by finance teams and bookkeepers. It’s known for robust financial tracking, bank reconciliation, and payroll management.

Key Features:

- Double-entry accounting with real-time bank syncing

- Multi-currency support and online invoicing

- Payroll integrations (especially in non-Indian markets)

- Project and job costing features

- Inventory and purchase order management

- Strong third-party app ecosystem

Why It’s Better Than QuickBooks:

- More modern UI and smoother cloud experience

- Easier collaboration with accountants and bookkeepers

- Powerful financial reports and real-time bank feeds

User ratings: 4.4/5 – G2

“I’ve been using Xero to manage my sales, invoices, and finances, and I must say it’s one of the best tools I’ve come across, especially since you don’t need an expert to deploy or implement it. Creating and customizing invoices is very straightforward, and the platform is intuitive and user-friendly, making it accessible even for those who are new to accounting software. It allows you to handle all types of sales, track expenses, manage bills, and connect directly to your bank account, all within a single system. One feature I particularly appreciate is Xero’s payment flexibility. The software supports a wide range of online payment options, including credit cards, online gateways, bank deposits, and even custom payment links. This flexibility lets customers choose the payment method that works best for them, which I’ve found especially useful for businesses of any size, from large enterprises to small startups. The payroll system is another highlight, even though it’s being phased out. With Xero Payroll, you can manage employee records, monitor hours and overtime, calculate salaries automatically, handle deductions, generate payslips, and file taxes where available. This makes payroll processing both accurate and efficient, helping to reduce stress. In areas where Xero doesn’t provide direct payroll support, it integrates smoothly with certified third-party providers. I’m also impressed by the real-time financial reporting. Xero provides profit and loss statements, sales reports, cash flow analyses, and comprehensive business overviews, giving you all the information you need to make informed decisions quickly.” – User on G2

Ideal For:

Accounting-heavy teams, startups with international operations, and businesses with in-house finance teams

5. TallyPrime

TallyPrime is one of India’s most popular accounting software solutions, widely used by traditional SMEs and CA firms for its simplicity and deep compliance support. It’s ideal for offline use but also works in cloud-hosted environments.

Key Features:

- GST and TDS-ready accounting

- Inventory, purchase, and sales management

- Banking integrations and cheque printing

- Payroll processing with compliance

- Business reports (P&L, balance sheet, ratio analysis)

- Supports multiple Indian languages

Why It’s Better Than QuickBooks:

- One-time licensing model, great for cost-conscious businesses

- Deep Indian compliance capabilities

- Offline and hybrid usage flexibility

- An extensive network of local partners for support

User ratings: 4.5/5 – G2

“What I appreciate most about TallyPrime is its ability to blend simplicity with depth — the interface feels light and intuitive, yet it handles complex accounting workflows like multi-GST returns, inventory, and cost centers without feeling bloated. Its keyboard-first navigation makes day-to-day operations lightning fast, especially for power users, and the fact that it’s fully offline with real-time reporting gives a sense of data security that cloud tools sometimes lack. For teams that value control and performance, TallyPrime strikes the right balance.” – User on G2

Ideal For:

Traditional Indian SMEs, manufacturing firms, retail shops, and businesses need full GST compliance and offline functionality

Comparison Table of QuickBooks Alternatives

Here’s the revised comparison table without the pricing column:

| Tool | Key Features | Pricing (Summary) | User Ratings | Best For (Expanded) |

|---|---|---|---|---|

| Flowace | – Fully automatic time tracking- Screenshots + activity monitoring- Productivity scoring & deep analytics- AI alerts for inactivity / performance drops- Attendance, shifts, leave management- Project/time allocation & billing- Executive dashboards | $1.99–$6.99/user/month (Enterprise custom) | ~4.6–5.0 | Remote & hybrid teams, agencies, IT firms, BPOs, and SMBs that want real-time productivity insights + automated time tracking + performance analytics. Ideal for businesses that need more than accounting—teams that want to understand how work is happening, not just how much is billed. |

| Zoho Books | – Full accounting suite- GST/TDS compliance- Project billing & time tracking- Banking, invoicing, vendor mgmt- Integrates deeply with Zoho ecosystem | ₹0–₹8,000/month (region dependent) | 4.4/5 | Startups, SMEs, and businesses already using Zoho apps. Perfect for India-based firms needing GST compliance, workflow automation, and affordable all-in-one financial + operational tools. |

| FreshBooks | – Project-based time tracking- Invoicing & recurring billing- Expense tracking & receipt capture- Client collaboration portal- Simple reporting | $19–$60/month | 4.5/5 | Freelancers, consultants, designers, creative pros, and small agencies. Great for teams wanting simple invoicing, lightweight accounting, and easy project/time management without the complexity of full accounting software. |

| Xero | – Double-entry accounting- Bank reconciliation- Multi-currency support- Inventory, purchase orders- Payroll integrations- Large app ecosystem | $15–$78/month | 4.4/5 | Scaling businesses with global operations, accountants, and finance-savvy teams. Ideal for companies needing advanced reporting, strong bank feeds, multi-currency, and collaboration-friendly cloud accounting. |

| TallyPrime | – GST/TDS-ready accounting- Inventory + purchase/sales mgmt- Payroll processing- Ratio analysis & business reports- Works offline or hybrid | One-time license + AMC | 4.5/5 | Traditional Indian SMEs, retail shops, manufacturers, and CA firms. Best for teams needing offline reliability, local compliance, ultra-fast operations, and deep control over inventory-led workflows. |

Why is Flowace the Best QuickBooks Alternative?

While QuickBooks has long been a favorite for accounting, it simply wasn’t designed with modern productivity or team efficiency in mind. That’s where Flowace shines. It’s more than just a time tracker—it’s a complete productivity optimization suite built for how businesses actually operate today.

Real-Time Productivity Insights

With Flowace, you’re not just tracking time, you’re unlocking a real-time view into how your team works. The platform breaks down employee activity into actionable dashboards, showing how much time is spent productively vs. distracted, which apps are being used, and where team members are spending their energy.

Unlike QuickBooks, which offers little beyond timesheet inputs, Flowace delivers dynamic data visualizations that help managers identify inefficiencies, celebrate top performers, and intervene early when someone is falling behind.

AI-Driven Analytics

One of Flowace’s standout advantages is its AI-powered behavioral analytics engine. It doesn’t just log time; it interprets patterns. Are employees multitasking too much? Which tools are causing distractions? When is each team member most productive?

This kind of intelligence is completely absent from QuickBooks, which focuses only on hours and dollars. Flowace, on the other hand, helps you make people-first decisions backed by AI—improving project planning, scheduling, and even employee well-being.

Effortless Time Tracking

QuickBooks requires manual entry or relies on clunky add-ons. Flowace flips the script with automated time tracking that starts and stops with your workflows.

Whether you’re switching tabs, taking a break, or jumping on a Zoom call, Flowace logs time in the background—accurately and silently—so teams can focus on work, not on clicking timers. It also features idle time detection, app & URL tracking, customizable work hours, and auto-generated timesheets.

Seamless Reporting & Automation

Flowace eliminates the hassle of compiling reports. While QuickBooks can generate accounting reports, it lacks meaningful team productivity reports, like task-level analytics, project timelines, or individual focus summaries.

With Flowace, you get weekly productivity summaries, attendance reports, daily work snapshots, client/project-specific billing data, and all of this is automated—customized to your preferences and ready for HR, leadership, or clients at the click of a button.

Used Across Industries and Teams

Flowace isn’t just for one niche. It’s built to support:

- Remote and hybrid teams needing transparency

- Agencies and consultancies tracking billable hours

- IT and product teams managing deep work time

- HR and operations streamlining performance insights

Companies across industries, from SaaS startups to digital marketing firms and IT services, have used Flowace to reduce timesheet errors, prevent burnout, and gain full clarity into team workflows.

Conclusion

QuickBooks is a strong financial tool, but modern productivity requires more than just accounting. Teams today are remote, fast-moving, and increasingly dependent on transparency and insight to get things done.

QuickBooks falls short when it comes to:

- Real-time productivity monitoring

- Automated, intelligent time tracking

- Insightful, people-first reporting

- Team-level performance management

Flowace picks up where QuickBooks leaves off, offering a complete, intelligent platform that empowers leaders to understand, optimize, and support how their teams work.

Frequently Asked Questions

1. Is Flowace a replacement for QuickBooks or a complementary tool?

Flowace is not an accounting platform like QuickBooks. Instead, it complements QuickBooks by adding real-time productivity insights, automated time tracking, and team performance analytics that QuickBooks does not offer. Many businesses use both together—QuickBooks for financial management and Flowace for operational efficiency.

2. Why should I switch from QuickBooks if my accounting needs are already covered?

If your business only requires accounting, QuickBooks is sufficient. However, modern teams need visibility into how work is happening, not just financial outcomes. QuickBooks lacks automated time tracking, productivity scoring, app/URL monitoring, and AI insights that help optimize performance. Switching (or pairing with Flowace) gives you deeper operational visibility.

3. Which QuickBooks alternative is best for Indian businesses?

Zoho Books and TallyPrime are particularly strong for Indian businesses. Zoho Books offers GST/TDS compliance, regional pricing, and seamless integration with Zoho’s ecosystem. TallyPrime is ideal for offline-first businesses, manufacturing units, and retail operations that need deep compliance and a one-time licensing model.

4. Why is Flowace considered the #1 alternative in 2026?

Flowace stands out because it solves a major gap QuickBooks leaves behind—real-time productivity and employee accountability. With automated tracking, AI-powered analytics, and detailed dashboards, Flowace helps leaders understand how work is being done, making it the top choice for remote, hybrid, and fast-scaling teams seeking deeper visibility.