Insurance BPO Services: These days, insurance company staff do most of their work online. They use computers to find potential customers and handle things like processing claims and signing up new clients.

Because of this, it’s really important to keep a close eye on what your insurance team is doing, minute by minute.

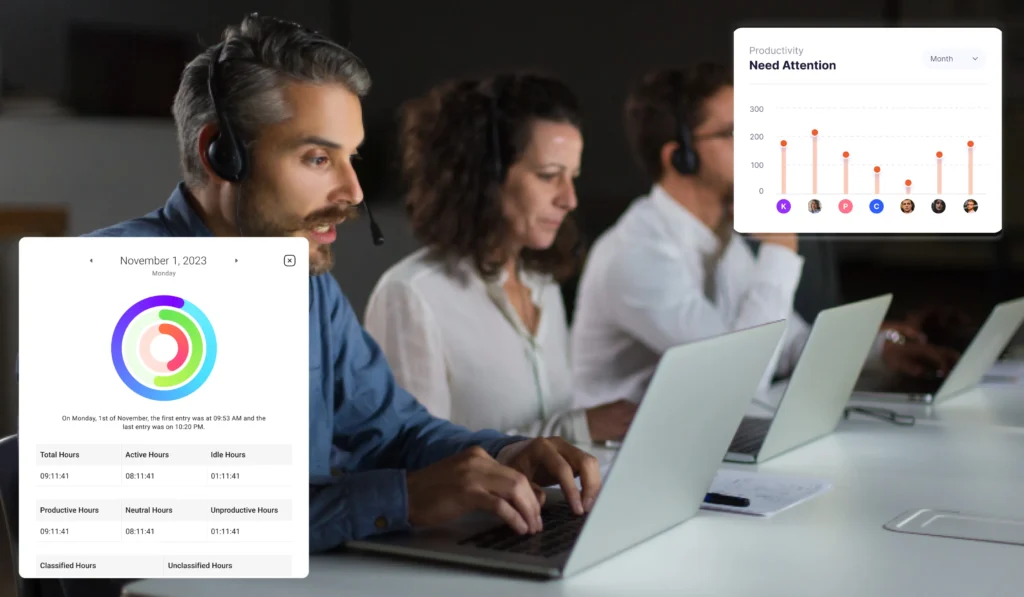

That’s where employee monitoring software like Flowace comes in handy. It helps ensure everyone stays safe while they work.

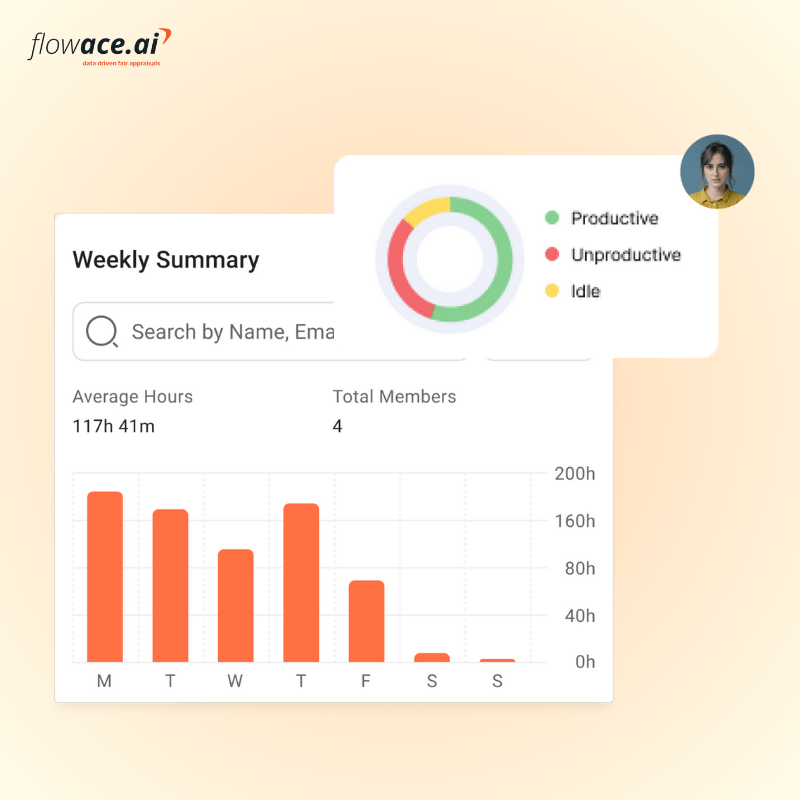

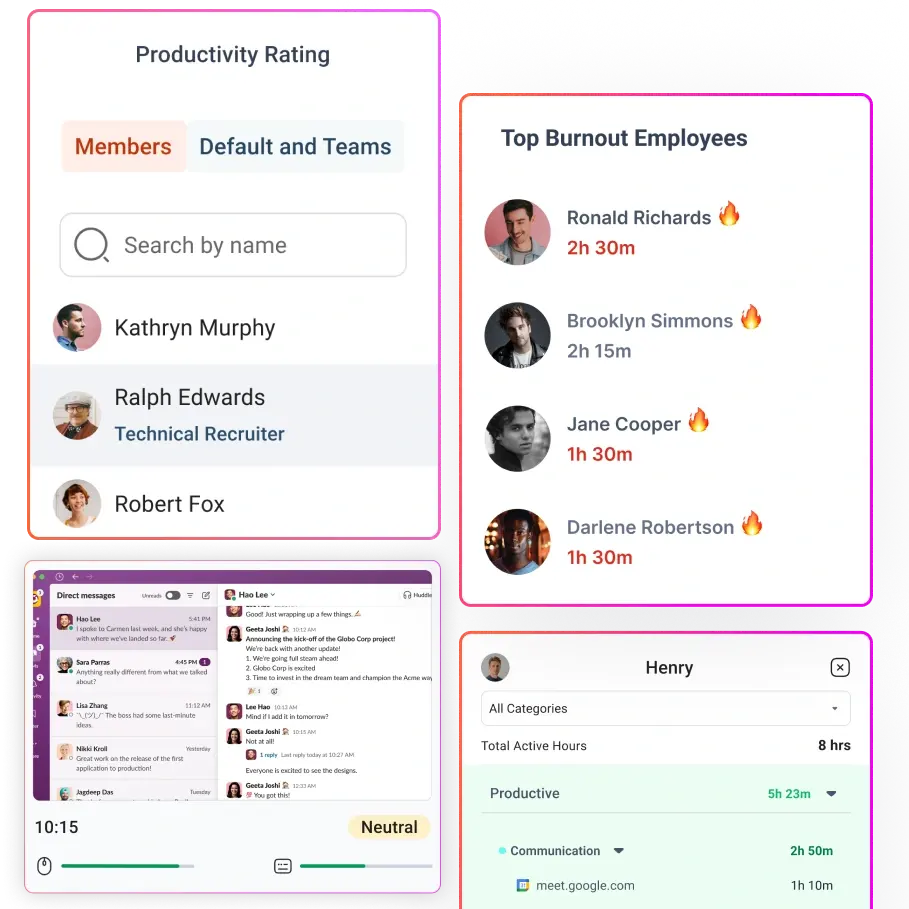

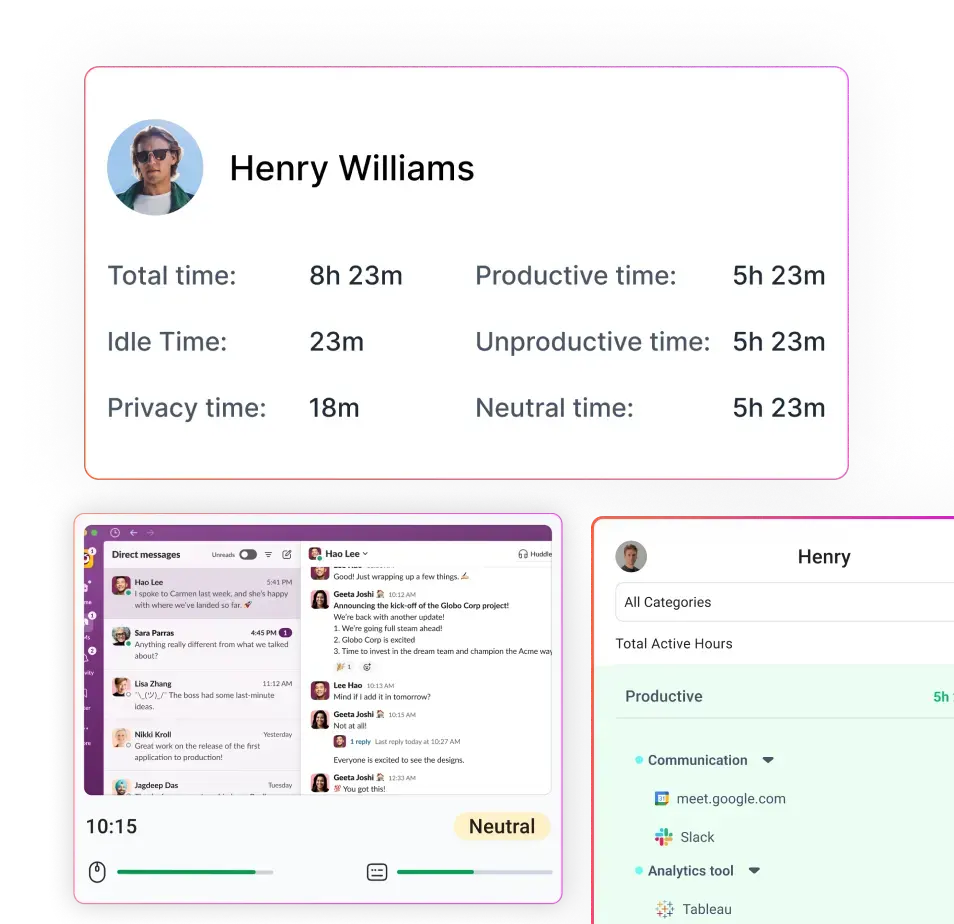

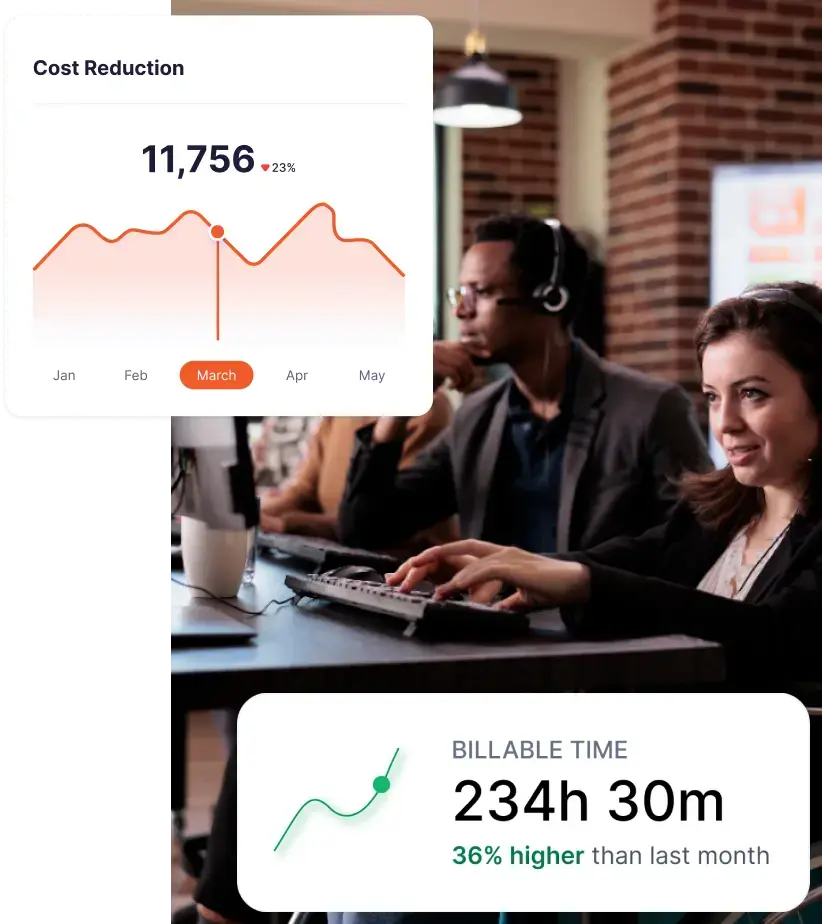

With this kind of software, you can keep tabs on how well your team is doing, see how things are progressing overall, and get a good picture of each team member’s performance.

In this article, let’s dive deep into why you need employee monitoring software and which tool is the most suitable for you!

How does tracking software help an insurance company?

Insurance companies need monitoring software by default because all the departments, like claims, underwriting, and call centers, rely heavily on the use of computers. It became even harder to track productivity once the remote working culture took the front seat.

As a result, the senior management of most insurance companies was worried that the company’s productivity may go down as direct control is absent.

This is where employee monitoring software solves all the problems regarding tracking productivity.

Let’s see the benefits of using tracking software to monitor your employees.

5 benefits of using tracking software to monitor employees in the insurance BPO services

- Use the data to improve productivity

- Frees up time for effective projects

- Measures time spent with each client

- It is impossible to manipulate the clock-in and clock-out time

- Claims processing gives you the data to analyze these processes better and set more realistic targets.

- Offer flexible work hours

- Keep insurance claims data secure

- Spot training needs

Many companies rely on basic time-tracking tools that overlook productivity insights and training needs. For instance, if you look at buddy punch pricing it shows how Flowace outperforms competitors in both cost and functionality.

1) Use the data to improve productivity

Using data to boost productivity isn’t a bad thing. You can show your employees this by explaining how it works. Plus, they’ll probably appreciate the idea of getting more done.

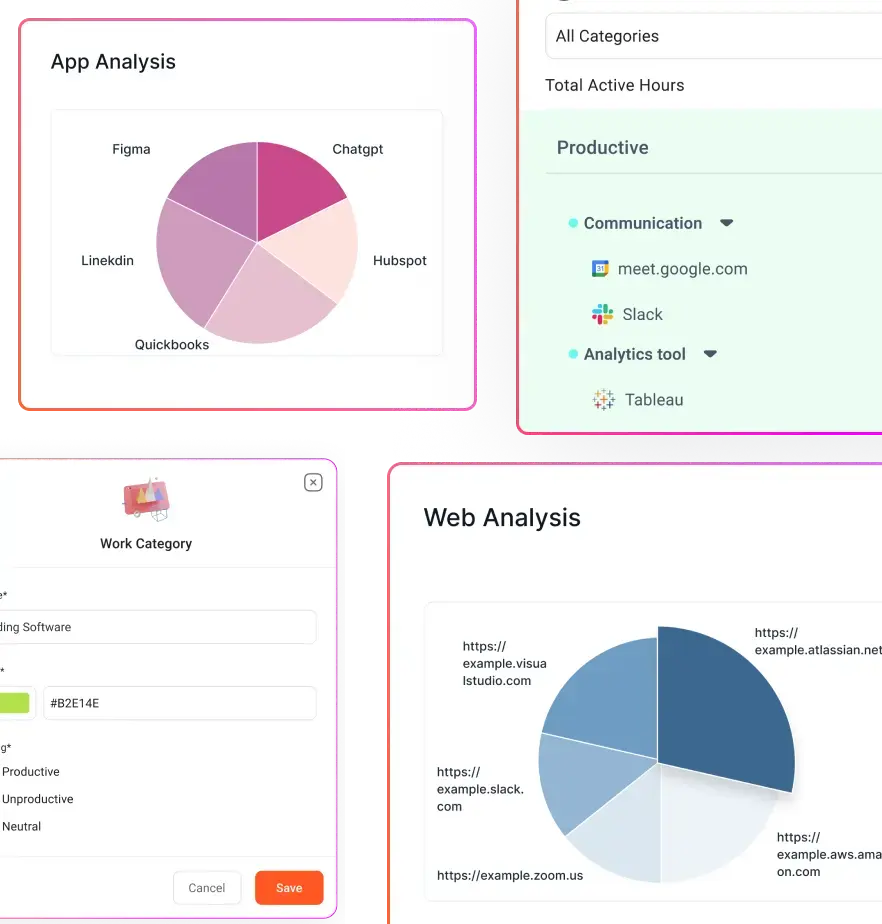

By looking at how your insurance brokers and analysts do their jobs, you can find ways to help them work smarter, not harder.

For instance, if you see that one software is better at handling claims than another, you can encourage everyone to use the more efficient option.

2) Frees up time for effective projects

When your team is tied up with administrative and back-office work, they can’t give their full attention to what matters. This can slow down your business growth and put you at a disadvantage compared to your competitors.

Bringing in monitoring software to manage your insurance BPO services can change that. It effectively measures where your team puts all their energy; this way, you can optimize so that your team can focus on top-notch service and reaching your company’s goals.

How HR managers can do employee monitoring while Working from Home!

3) Measures time spent with each client

When it comes to client-facing roles in insurance, much time is spent away from the computer. Employee tracking apps only show what’s happening on screens, leaving other activities out of sight.

But don’t worry; your team’s face-to-face time with clients won’t go unnoticed. Even though it won’t show up as active computer time, you’ll still keep track of when they’re meeting clients or having important phone calls about insurance policies.

Some systems, like Flowace, even let you manually add these activities, ensuring all the details are in one convenient place.

4) It is impossible to manipulate the clock-in and clock-out time

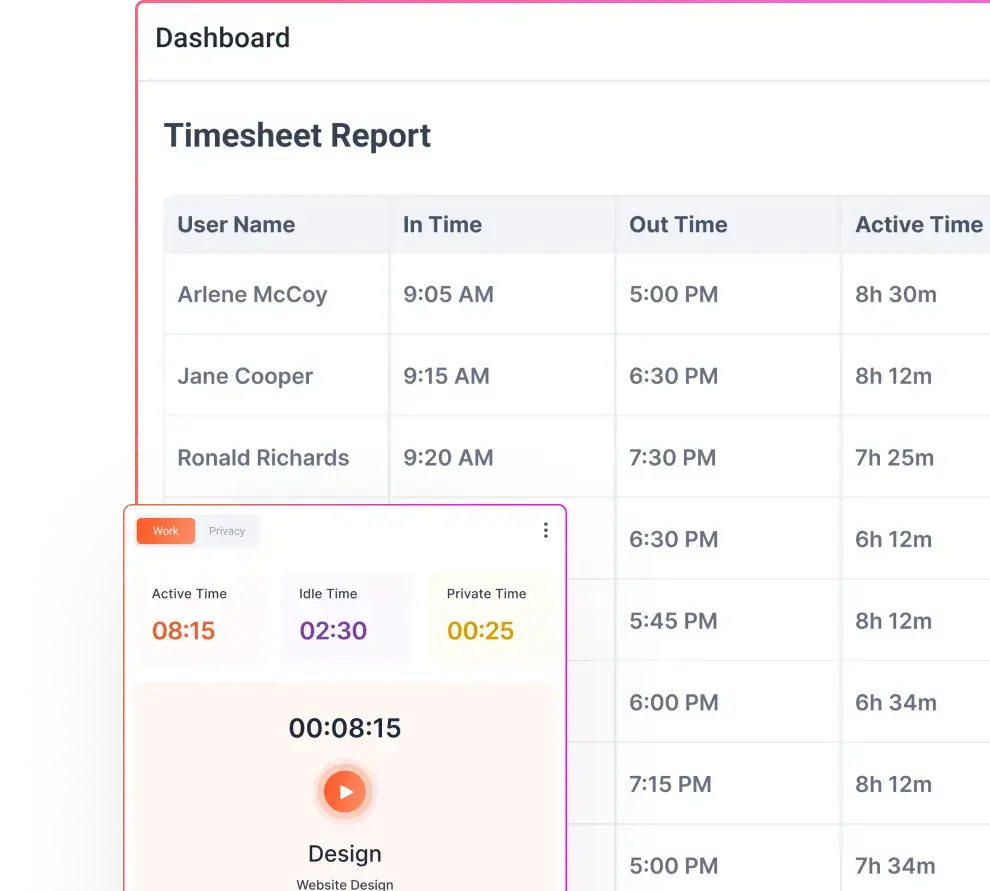

Data never lies. This holds true as so many remote companies face the issue of employees manipulating their clock-in time and needing to be more productive for a long time.

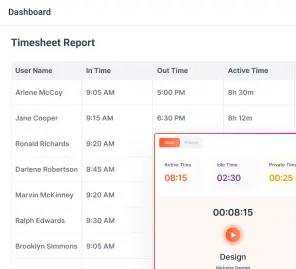

However, a tracking tool like Flowace automatically measures your employees’ clocking time once they open the laptop. This can be enabled with the Flowace extension installed on the employees’ laptops.

Also, this makes it tougher for them to mess with their clock-ins or outs, like buddy-punching or other tricks. And if anyone’s running late, it’ll be harder for them to hide it.

Top 5 Productivity & Automation Tools for IT Firms

5) Claims processing gives you the data to analyze these processes better and set more realistic targets.

For example, you will know exactly how much time your employees spend engaging with customers and solving their problems via phone or email.

Your team will like knowing that these targets will be based on their actual performance, not some unrealistic ideal. Plus, you can use the time-tracking data to figure out where to streamline or automate parts of the claim processing to make everyone more efficient.

a) Offer flexible work hours

Give your remote insurance agents or BPO staff the freedom to choose their work hours. The old idea of sitting at a desk for eight hours must be updated.

Let your employees work around their lives instead of the other way around to keep your business up-to-date. Track how much time individuals and teams spend on projects.

This way, you can figure out project costs by assigning hourly rates to the time they put in.

5 Finest Employee Time-Tracking Software for Businesses in 2024

b) Keep insurance claims data secure

Keeping insurance claim data safe is crucial because it’s often very sensitive. That’s why it’s important to protect it from leaks.

With Flowace Employee Monitoring Software, you can set up incident alerts. If any official data gets leaked, you’ll get a notification immediately so you can take action.

c) Spot training needs

If certain tasks are taking longer than usual, it may be because your team needs more know-how. Find out where there are gaps in knowledge, and set up extra training to help your team work better and achieve more.

How can Flowace help BPO insurance companies achieve maximum productivity?

In India, the insurance BPO industry is highly competitive, and the measurement of productivity can only be predicted with a tool in place.

This is where Flowace, a handy time-tracking tool, can help you maximize productivity by up to 31% with a very short turnaround time.

Many of our BPO customers have seen huge success when implementing Flowace. And the icing on the cake is that our tool is the most affordable among any other competitors on the market.

So why wait?

Every day, you hesitate to make the decision that you’re losing money over lost productivity.

Get on a call with us to learn more!